In the ever-evolving world of cryptocurrency, the role of a crypto wallet cannot be overstated. Whether you’re a seasoned investor or a newcomer, understanding how crypto wallets function is essential to navigating the digital financial landscape. This article will explore what crypto MetaMask extension are, the different types, and their importance in securing digital assets.

What is a Crypto Wallet?

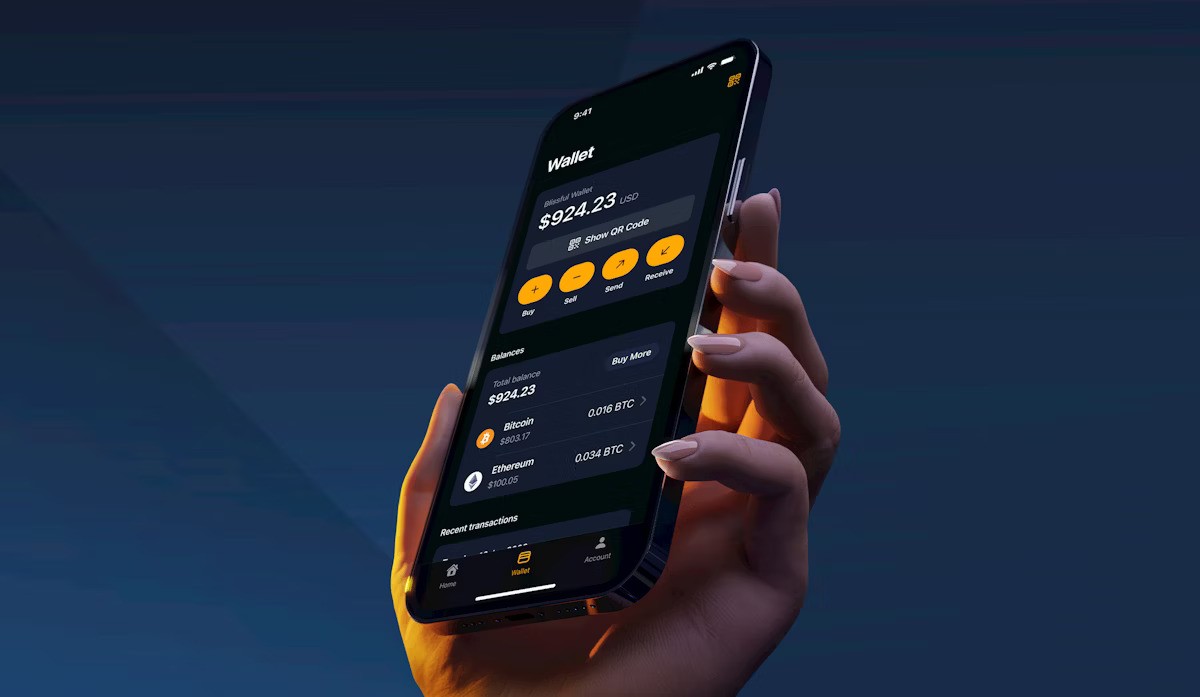

A cryptocurrency wallet is a digital tool that allows users to store and manage their cryptocurrencies like Bitcoin, Ethereum, and many others. Unlike traditional wallets that store physical money, a crypto wallet stores the private and public keys needed to conduct transactions on the blockchain network.

These wallets do not hold the cryptocurrencies themselves (as digital currencies exist on the blockchain), but they provide the necessary keys to access, send, and receive these assets. Think of it as a secure digital interface between the user and the blockchain.

Types of Crypto Wallets

Crypto wallets come in two main categories: hot wallets and cold wallets.

1. Hot Wallets

Hot wallets are connected to the internet, making them convenient for frequent transactions. These are ideal for users who need quick access to their funds, such as day traders or those making regular purchases. However, because they are always online, they are more vulnerable to cyberattacks, phishing, and malware.

Examples of hot wallets include:

- Software Wallets: These are applications that can be installed on a computer or smartphone. Examples include Exodus and Electrum.

- Web Wallets: These wallets operate directly in a web browser, such as those provided by platforms like MetaMask or Blockchain.com.

2. Cold Wallets

Cold wallets, on the other hand, are offline storage solutions that offer enhanced security. They are not connected to the internet, which makes them resistant to hacking attempts. These wallets are typically used for long-term storage and are best suited for users holding large amounts of crypto.

Examples of cold wallets include:

- Hardware Wallets: Physical devices like Ledger and Trezor that store private keys securely offline.

- Paper Wallets: A physical printout of a user’s private and public keys, often generated offline.

How Crypto Wallets Work

Crypto wallets function by managing a pair of cryptographic keys:

- Public Key: This is your wallet address and can be shared with others so they can send you cryptocurrency.

- Private Key: This is the most critical component. It is used to sign transactions and access your funds. Only the wallet owner should have access to the private key, and it must be kept secure.

When you want to send cryptocurrency, your wallet uses the private key to sign a transaction, which is then verified by the blockchain network. Without the private key, you cannot access your funds. This is why safeguarding your private key is paramount.

Why Do You Need a Crypto Wallet?

- Security: A crypto wallet is a crucial tool for keeping your funds safe. Since the blockchain is decentralized and not controlled by any central authority, it is up to the user to protect their assets. A wallet offers a secure way to store your private keys and manage your transactions.

- Ownership and Control: With a crypto wallet, you have full ownership of your digital assets. You don’t need a third party (like a bank) to access or manage your funds. This decentralization is a fundamental principle of cryptocurrencies.

- Access to the Blockchain: Crypto wallets allow users to interact with the blockchain, enabling them to send and receive cryptocurrency, as well as access decentralized applications (dApps) and smart contracts.

Tips for Securing Your Crypto Wallet

- Use a Hardware Wallet for Large Amounts: For those holding substantial amounts of cryptocurrency, using a hardware wallet offers the highest level of security.

- Enable Two-Factor Authentication (2FA): If available, always enable 2FA on hot wallets and exchanges for an added layer of protection.

- Backup Your Keys: Store backups of your private key in multiple secure locations. Losing access to your private key means losing access to your funds permanently.

- Be Wary of Phishing Attempts: Always ensure you are accessing your wallet through official websites and apps. Be cautious of unsolicited emails or messages that may trick you into revealing your private key.

- Use Strong Passwords: Always use a strong and unique password for your wallet accounts, especially for online wallets or exchanges.

Conclusion

Crypto wallets are fundamental to the world of cryptocurrencies, serving as a secure means to store, manage, and transact digital assets. By understanding the different types of wallets, how they function, and the security measures necessary, users can confidently participate in the blockchain ecosystem.